Unconscionable Debt Collection Practices of Child Support Enforcement

by Giovanni LoPresti

As an American Citizen, you want to believe that any person can rely upon judicial fairness in a child support proceeding. The outrageous child support law on the books today is designed to treat all child support debtors like a piece of garbage. The wisdom of common sense, respect, judicial fairness, doesn’t exist under the present law. The mastermind of this unconscionable child support enforcement law was created by former Senator Bill Bradley of New Jersey.

As an American Citizen, you want to believe that any person can rely upon judicial fairness in a child support proceeding. The outrageous child support law on the books today is designed to treat all child support debtors like a piece of garbage. The wisdom of common sense, respect, judicial fairness, doesn’t exist under the present law. The mastermind of this unconscionable child support enforcement law was created by former Senator Bill Bradley of New Jersey.

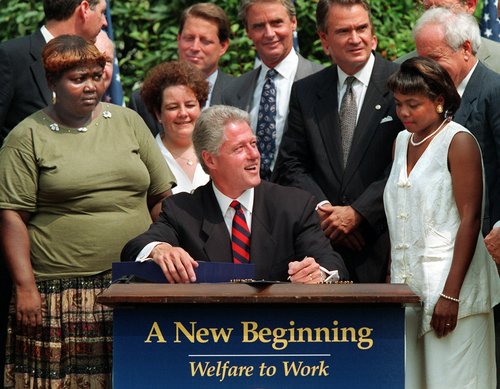

His Senate Bill modified U.S. Code Title IV-D (42 U.S.C. § 666(a)(9)(c)) which requires state courts to prohibit retroactive reduction of child support obligations. The law abolished the statute of limitations, created a civil judgment by operation of law on all child support debtors, allows adverse credit reporting, allows a cost of living adjustment every two years, allows for review of child support orders every 3 years, without a showing of substantial change in circumstance, allows for a suspension of drivers licenses, passports, professional licenses, income withholding, tax intercepts, unemployment & workman compensation intercepts, requires citizen to provide their social security numbers, requires employers to utilize new hire directory to see if a child support debt is owed, provides locator services, requires health care coverage to be provided by either or both parents, and requires a debtor citizen to show proof of substantial change in circumstances necessary in request for review outside 3-year cycle.

I would like to focus on the requirement of proof of substantial change in circumstances necessary in requesting a review of child support outside 3-year cycle. The law offers no guidance whatsoever on what constitutes a substantial chance in circumstances. Similarly, the Office of Child Support Enforcement offers no guidance either. With no guidance whatsoever, the law requires payments to be maintained without regard of a citizen’s ability to pay.

I would like to focus on the requirement of proof of substantial change in circumstances necessary in requesting a review of child support outside 3-year cycle. The law offers no guidance whatsoever on what constitutes a substantial chance in circumstances. Similarly, the Office of Child Support Enforcement offers no guidance either. With no guidance whatsoever, the law requires payments to be maintained without regard of a citizen’s ability to pay.

In my view, common sense and judicial fairness would dictate that an injury, illness, loss of employment at no fault of a citizen, whether temporary or not, would constitute a substantial change in financial circumstances? Nonetheless, family court judges throughout the United States have consistently rejected a child support debtor’s request for child support reduction under these circumstances. I asked myself over and over again, why are family court judges are so mean and lack understanding and compassion? The answer to this question is going to shock you.

Under the present law, there is a presumption that child support award is correct and a citizen debtor has the ability to pay or find similar work at the same rate of pay, even if you’re not making the same amount of money. Put simply, Congress has provided family court judges physic abilities to determine a citizen earning capabilities. I find this horrifying, but family court judges find no shame in it. I have heard endless horror stories of citizens whose financial circumstances changed, and denied judicial fairness in family court. Unfortunately, this is what will likely happen if your financial circumstances change:

1. Unemployment or workmen compensation garnished at the full amount.

2. Your ability to support yourself doesn’t matter.

3. Fall behind at no fault of your own, driver’s license, professional license, passport

revoked.

4. Your credit will be destroyed.

5. You can expect armed law enforcement showing up and putting you in county jail

for failure to pay child support.

6. Tax refund intercepted.

WHY A CHILD SUPPORT DEBTORS ARE DENIED JUDICIAL FAIRNESS

WHEN FINANCIAL CIRCUMSTANCES CHANGE

My researched has revealed that most Americans are unaware that our federal government reimburses States 66% of collection cost expended for child support enforcement, see Title IV under the Social Security Act. This doesn’t bother me, but the additional incentive dollars the States receive to treat citizens like garbage does. Under Title IV:

My researched has revealed that most Americans are unaware that our federal government reimburses States 66% of collection cost expended for child support enforcement, see Title IV under the Social Security Act. This doesn’t bother me, but the additional incentive dollars the States receive to treat citizens like garbage does. Under Title IV:

States receive additional incentive dollars for:

a. paternity establishment

b. order establishment

c. collection on current support cases

d. cases paying towards arrears

e. cost effectiveness

f. performance

So regardless of a child support debtors changed financial circumstances, a family court judge will routinely deny any request for a reduction or, even a temporary reduction. The unfortunate truth, family court judges armed with physic abilities to determine a citizen’s earning abilities, don’t care. They are the front line in defending the State’s performance incentives. A family court judge will bully a citizen by denying any type of relief sought, suspend your driver’s license, professional license, passport, may incarcerate you for failure to pay child support without a finding of ability to pay, intercept your tax return, garnish your unemployment or workman’s compensation, destroy your credit, and your home State will receive additional incentive dollars from our federal government for doing this to you. This is not only insane, cruel, unconscionable, but definitely creates an appearance of impropriety.

So regardless of a child support debtors changed financial circumstances, a family court judge will routinely deny any request for a reduction or, even a temporary reduction. The unfortunate truth, family court judges armed with physic abilities to determine a citizen’s earning abilities, don’t care. They are the front line in defending the State’s performance incentives. A family court judge will bully a citizen by denying any type of relief sought, suspend your driver’s license, professional license, passport, may incarcerate you for failure to pay child support without a finding of ability to pay, intercept your tax return, garnish your unemployment or workman’s compensation, destroy your credit, and your home State will receive additional incentive dollars from our federal government for doing this to you. This is not only insane, cruel, unconscionable, but definitely creates an appearance of impropriety.

States routinely incarcerate child support debtors, without any determination that they have the ability to pay. Our States actually get paid additional incentive dollars from our federal government for incarnating a child support debtor. The States routinely tell citizens that they are court ordered to pay child support and find them in civil contempt. However, the court order is also a civil judgment by operation of law. Did you ever hear of any situation whereby any judge would allow any person to have a slice a cake and eat it too? For example, if you obtained a civil judgment against me, you can’t suspend my passport, driver’s license, professional license, intercept my tax return, garnish my unemployment or disability check, hold me in contempt, and jail me for failure to pay a debt. Special thanks to our federal government, state government are permitted to have a slice of cake and eat it too.

The last time I checked, the 14th Amendment prohibits States from denying any person within its territory the equal protection of the laws. The federal government must do the same, but this is also required by the 5th Amendment Due Process Clause. All citizens should be entitled to judicial fairness in any court proceeding. I urge all citizens to write their elected officials and asked them to repeal this unconscionable law. Alternatively, send your elected official a strong message and vote them out of office. A debtor citizen cannot rely upon judicial fairness in a family court proceeding, if a State has a financial interest in maintaining additional incentives dollars.

The last time I checked, the 14th Amendment prohibits States from denying any person within its territory the equal protection of the laws. The federal government must do the same, but this is also required by the 5th Amendment Due Process Clause. All citizens should be entitled to judicial fairness in any court proceeding. I urge all citizens to write their elected officials and asked them to repeal this unconscionable law. Alternatively, send your elected official a strong message and vote them out of office. A debtor citizen cannot rely upon judicial fairness in a family court proceeding, if a State has a financial interest in maintaining additional incentives dollars.

The public views court-ordered formulas calculating child support in the United States and England to be unfair, according to a study released Monday. Articles proclaim that researchers hope that this will be valuable information for policymakers dealing with family law issues. Existing child support law is not consistent with the basic application of fairness that most people have.

The public views court-ordered formulas calculating child support in the United States and England to be unfair, according to a study released Monday. Articles proclaim that researchers hope that this will be valuable information for policymakers dealing with family law issues. Existing child support law is not consistent with the basic application of fairness that most people have. This study used face-to-face questions and feelings about certain courtroom scenarios. Respondents were found to be three times as responsive than the law when it came to adjusting child support based on income changes of the noncustodial parent. In one hypothetical scenario, if the noncustodial parent made less than a custodial parent, the amount of child support would be lowered, by $100. In that case, the respondents reported they would actually lower the amount by $300. Judges have grown to be jaded and unfair.

This study used face-to-face questions and feelings about certain courtroom scenarios. Respondents were found to be three times as responsive than the law when it came to adjusting child support based on income changes of the noncustodial parent. In one hypothetical scenario, if the noncustodial parent made less than a custodial parent, the amount of child support would be lowered, by $100. In that case, the respondents reported they would actually lower the amount by $300. Judges have grown to be jaded and unfair. Child support is routinely established at levels higher than the noncustodial parent can pay. Child support is determined by judges who refer to an income table and set of guidelines. Judges do have the authority to depart from those guidelines and modify amounts depending on certain circumstances, but they must justify in writing why a case needs different treatment. This may, or may not be a problem. Yet, the difficulty of modifying court-ordered child support in situations where non-custodial parents have lost their job or had a pay cut is another shortcoming of the current system. Fear is designed to be the continued motivation for the non-custodial parent.

Child support is routinely established at levels higher than the noncustodial parent can pay. Child support is determined by judges who refer to an income table and set of guidelines. Judges do have the authority to depart from those guidelines and modify amounts depending on certain circumstances, but they must justify in writing why a case needs different treatment. This may, or may not be a problem. Yet, the difficulty of modifying court-ordered child support in situations where non-custodial parents have lost their job or had a pay cut is another shortcoming of the current system. Fear is designed to be the continued motivation for the non-custodial parent.

By his own telling, the first time Walter L. Scott went to jail for failure to pay child support, it sent his life into a tailspin. He lost what he called “the best job I ever had” when he spent two weeks in jail. Some years he paid. More recently, he had not. Two years ago, when his debt reached nearly $8,000 and he missed a court date, a warrant was issued for his arrest. By last month, the amount had more than doubled, to just over $18,000.

By his own telling, the first time Walter L. Scott went to jail for failure to pay child support, it sent his life into a tailspin. He lost what he called “the best job I ever had” when he spent two weeks in jail. Some years he paid. More recently, he had not. Two years ago, when his debt reached nearly $8,000 and he missed a court date, a warrant was issued for his arrest. By last month, the amount had more than doubled, to just over $18,000. “Every job he has had, he has gotten fired from because he went to jail because he was locked up for child support,” said Mr. Scott, whose brother was working as a forklift operator when he died. “He got to the point where he felt like it defeated the purpose.”

“Every job he has had, he has gotten fired from because he went to jail because he was locked up for child support,” said Mr. Scott, whose brother was working as a forklift operator when he died. “He got to the point where he felt like it defeated the purpose.” The problem begins with child support orders that, at the outset, can exceed parents’ ability to pay. When parents fall short, the authorities escalate collection efforts, withholding up to 65 percent of a paycheck, seizing bank deposits and tax refunds, suspending driver’s licenses and professional licenses, and then imposing jail time.

The problem begins with child support orders that, at the outset, can exceed parents’ ability to pay. When parents fall short, the authorities escalate collection efforts, withholding up to 65 percent of a paycheck, seizing bank deposits and tax refunds, suspending driver’s licenses and professional licenses, and then imposing jail time. Unpaid child support became a big concern in the 1980s and ’90s as public hostility grew toward the archetypal “deadbeat dad” who lived comfortably while his children suffered. Child support collections were so spotty that in the late 1990s, new enforcement tools such as automatic paycheck deductions were used. As a result, child support collections increased significantly, and some parents rely heavily on aggressive enforcement by the authorities.

Unpaid child support became a big concern in the 1980s and ’90s as public hostility grew toward the archetypal “deadbeat dad” who lived comfortably while his children suffered. Child support collections were so spotty that in the late 1990s, new enforcement tools such as automatic paycheck deductions were used. As a result, child support collections increased significantly, and some parents rely heavily on aggressive enforcement by the authorities. In many jurisdictions, support orders are based not on the parent’s actual income but on “imputed income” — what they would be expected to earn if they had a full-time, minimum wage or median wage job. In South Carolina, the unemployment rate for black men is 12 percent.

In many jurisdictions, support orders are based not on the parent’s actual income but on “imputed income” — what they would be expected to earn if they had a full-time, minimum wage or median wage job. In South Carolina, the unemployment rate for black men is 12 percent. Under a 2011 Supreme Court ruling, courts are not supposed to jail a defendant without a specific finding that he or she has the ability to pay. But that process does not always work as intended, especially when the client does not have a lawyer, advocates for the poor say.

Under a 2011 Supreme Court ruling, courts are not supposed to jail a defendant without a specific finding that he or she has the ability to pay. But that process does not always work as intended, especially when the client does not have a lawyer, advocates for the poor say.

Jahmal Holmes, 28, is a current participant in the Father to Father program in North Charleston. He has two children, 4 and 8, and said he had agreed to court-ordered child support because he had been told that it was a requirement for their mother to receive Medicaid. The two have since broken up and share custody of the younger child, but he is still required to pay support for both.

Jahmal Holmes, 28, is a current participant in the Father to Father program in North Charleston. He has two children, 4 and 8, and said he had agreed to court-ordered child support because he had been told that it was a requirement for their mother to receive Medicaid. The two have since broken up and share custody of the younger child, but he is still required to pay support for both. Rodney Scott said that he sometimes thought his brother did not do everything he could to catch up, but that Walter seemed to consider it a hopeless cause. He recalled seeing his brother plead to a judge that he just did not make enough money.

Rodney Scott said that he sometimes thought his brother did not do everything he could to catch up, but that Walter seemed to consider it a hopeless cause. He recalled seeing his brother plead to a judge that he just did not make enough money.

A growing number of Americans are frustrated with the way in which their economy has been managed and are becoming increasingly concerned about future measures the government may take to keep its coffers full.

A growing number of Americans are frustrated with the way in which their economy has been managed and are becoming increasingly concerned about future measures the government may take to keep its coffers full. With a few exceptions, the IRC imposes taxes on both U.S. source income and foreign source income of U.S. citizens. Non-resident, non-U.S. citizens (also known as “non-resident aliens”) pay tax only on U.S. source income, although some U.S. sources of income (e.g., most capital gains) are tax-free.

With a few exceptions, the IRC imposes taxes on both U.S. source income and foreign source income of U.S. citizens. Non-resident, non-U.S. citizens (also known as “non-resident aliens”) pay tax only on U.S. source income, although some U.S. sources of income (e.g., most capital gains) are tax-free. Once you give up U.S. citizenship and passport, you no longer have the right to live in the United States. You may generally make brief visits, but in most cases, you won’t be able to stay more than approximately four months annually without becoming subject to U.S. tax on your worldwide income based on the IRC’s “deemed residence” rules discussed in Part II of this report. Finding another country to live in is therefore an essential part of any expatriation exit strategy.

Once you give up U.S. citizenship and passport, you no longer have the right to live in the United States. You may generally make brief visits, but in most cases, you won’t be able to stay more than approximately four months annually without becoming subject to U.S. tax on your worldwide income based on the IRC’s “deemed residence” rules discussed in Part II of this report. Finding another country to live in is therefore an essential part of any expatriation exit strategy.